Invite Scene - #1 to Buy, Sell, Trade or Find Free Torrent Invites

#1 TorrentInvites Community. Buy, Sell, Trade or Find Free Torrent Invites for Every Private Torrent Trackers. HDB, BTN, AOM, DB9, PTP, RED, MTV, EXIGO, FL, IPT, TVBZ, AB, BIB, TIK, EMP, FSC, GGN, KG, MTTP, TL, TTG, 32P, AHD, CHD, CG, OPS, TT, WIHD, BHD, U2 etc.

LOOKING FOR HIGH QUALITY SEEDBOX? EVOSEEDBOX.COM PROVIDES YOU BLAZING FAST & HIGH END SEEDBOXES | STARTING AT $5.00/MONTH!

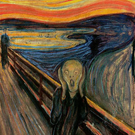

Bitcoin Spikes Back To $6000: Five Reasons Why It's Not A Bubble

-

Check out what our members are saying

Quick, to the point, good job invitescene !Fast and reliable, highly recommend. Hi everyone, I am presenting a thought after purchasing an Invite from this site. Inviter was super instantaneous to get back to me after I had questioned if he had any avai…Inviter provides lower prices than other providers and other forum owners by a higher margin. He is the man to buy from if you are looking for a torrent invites to any website h…Very prompt and professional.Don't know how he does it, but @Inviter delivers! Had a smooth transaction, no hiccups!The service was really fast and fair. There haven't been any problems, and the seller was very professional.Everything was fine. He made a huge effort to find invite for me. Great communication. So if You need an Invite just contact @Inviter

Hi everyone, I am presenting a thought after purchasing an Invite from this site. Inviter was super instantaneous to get back to me after I had questioned if he had any avai…Inviter provides lower prices than other providers and other forum owners by a higher margin. He is the man to buy from if you are looking for a torrent invites to any website h…Very prompt and professional.Don't know how he does it, but @Inviter delivers! Had a smooth transaction, no hiccups!The service was really fast and fair. There haven't been any problems, and the seller was very professional.Everything was fine. He made a huge effort to find invite for me. Great communication. So if You need an Invite just contact @Inviter It's the first time I ever bought an invite for a private tracker, but after seeing as how certain private trackers are impossible to get into unless you know somehow or have so…Absolutely patient and wonderful delivery. I really have nothing negative to say. Highly recommended!

It's the first time I ever bought an invite for a private tracker, but after seeing as how certain private trackers are impossible to get into unless you know somehow or have so…Absolutely patient and wonderful delivery. I really have nothing negative to say. Highly recommended! Promptly and effectively fixed a problem with one of the product (my error, not seller's). Will definitely be back and will recommend to others as a quality vendor. 5/5 Stars. A…Easy, fast and simple - What more could you want?

Promptly and effectively fixed a problem with one of the product (my error, not seller's). Will definitely be back and will recommend to others as a quality vendor. 5/5 Stars. A…Easy, fast and simple - What more could you want? I was nervous spending so much money on an invite at first and there has been some delay due to how hard the access to empornium.me is. But I remained calm and waited for the ve…Professional all the way. Informative through the whole process.Il migliore venditore, 100%+Vouch Very Smooth Communication Bought an invite, I will be buying many more invites for sure and hopefully we can build long term relation. Recommended for sure.Well, he was really fast and loved that he didn't ask much and simply sent me an invite. 😊 It was painless and prompt. Thanks a lot, man.

I was nervous spending so much money on an invite at first and there has been some delay due to how hard the access to empornium.me is. But I remained calm and waited for the ve…Professional all the way. Informative through the whole process.Il migliore venditore, 100%+Vouch Very Smooth Communication Bought an invite, I will be buying many more invites for sure and hopefully we can build long term relation. Recommended for sure.Well, he was really fast and loved that he didn't ask much and simply sent me an invite. 😊 It was painless and prompt. Thanks a lot, man. Inviter supported me a lot and was super fast for the torrent access that I wanted. I will for sure request help from him when I need something else. Glad I reached him and regis…Definitely, you can trust him. Fast and efficient.

Inviter supported me a lot and was super fast for the torrent access that I wanted. I will for sure request help from him when I need something else. Glad I reached him and regis…Definitely, you can trust him. Fast and efficient. Awsome service i love it thanks alotExtremely professional seller. No fuss deal. Very friendly and his after-sales service and advice is truly unparalleled. Buy with full confidence. And even if he does take a few…

Awsome service i love it thanks alotExtremely professional seller. No fuss deal. Very friendly and his after-sales service and advice is truly unparalleled. Buy with full confidence. And even if he does take a few… very communicative, fast responses!

very communicative, fast responses! Quick transaction, honest, friendly and very helpful. Highly recommended!That was awesome 💯💯, I have been looking for invitations for a long time and I was completely disappointed but now with @Inviter i registered in the site I wanted. Thanks a lot …

Quick transaction, honest, friendly and very helpful. Highly recommended!That was awesome 💯💯, I have been looking for invitations for a long time and I was completely disappointed but now with @Inviter i registered in the site I wanted. Thanks a lot … First of all, thank you so much for retaining me. Inviter helped with my questioning and directed me to the best torrentinvites to fetch on. The approaches were super smooth, and…

First of all, thank you so much for retaining me. Inviter helped with my questioning and directed me to the best torrentinvites to fetch on. The approaches were super smooth, and… First exchange I made, reasonable price, convenient payment method, simple and instant reactivity, no problem at all.Inviter was very punctual in replying to all of my questionings and supervised me through the purchasing process. Everything worked just as he agreed, and there were no issues wi…

First exchange I made, reasonable price, convenient payment method, simple and instant reactivity, no problem at all.Inviter was very punctual in replying to all of my questionings and supervised me through the purchasing process. Everything worked just as he agreed, and there were no issues wi… Excellent - Very reliable and honest trade - Quick service was provided - much appreciated. Thank you @Inviter for a great service.

Excellent - Very reliable and honest trade - Quick service was provided - much appreciated. Thank you @Inviter for a great service. -

Our picks

-

Buy Empornium Invite

Inviter posted a topic in Premium Sellers Section,

Offering Empornium.is / Empornium.sx / Empornium.me / Empornium / EMP Invite, PM me for the price.

Commodity URL: https://www.empornium.is/, https://www.empornium.sx/, https://www.empornium.me/

Commodity REVIEW: https://www.invitescene.com/topic/40396-empornium-emp-porn-2020-review/-

-

- 692 replies

Picked By

Inviter, -

-

Buy BroadcasTheNet Invite

Inviter posted a topic in Premium Sellers Section,

For limited time I'm offering BroadcasThe.Net (BTN) Invite, PM me for price.

URL: https://broadcasthe.net/-

-

- 371 replies

Picked By

Inviter, -

-

![[In Stock] Buy REDActed.CH (RED) Invite](//www.invitescene.com/applications/core/interface/js/spacer.png)

[In Stock] Buy REDActed.CH (RED) Invite

Inviter posted a topic in Premium Sellers Section,

For limited time I'm offering REDActed.CH (RED) Invite, PM me for price.

URL: https://redacted.ch/-

-

- 112 replies

Picked By

Inviter, -

-

.thumb.jpg.fbd4ae3eec9dfa2f0ee86b4584a7f8a7.jpg)

![[In Stock] Buy REDActed.CH (RED) Invite](https://www.invitescene.com/uploads/monthly_2019_12/Redacted.png.a96849d08b6f36b6140a4ead4a4cceba.png)

Recommended Posts

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.